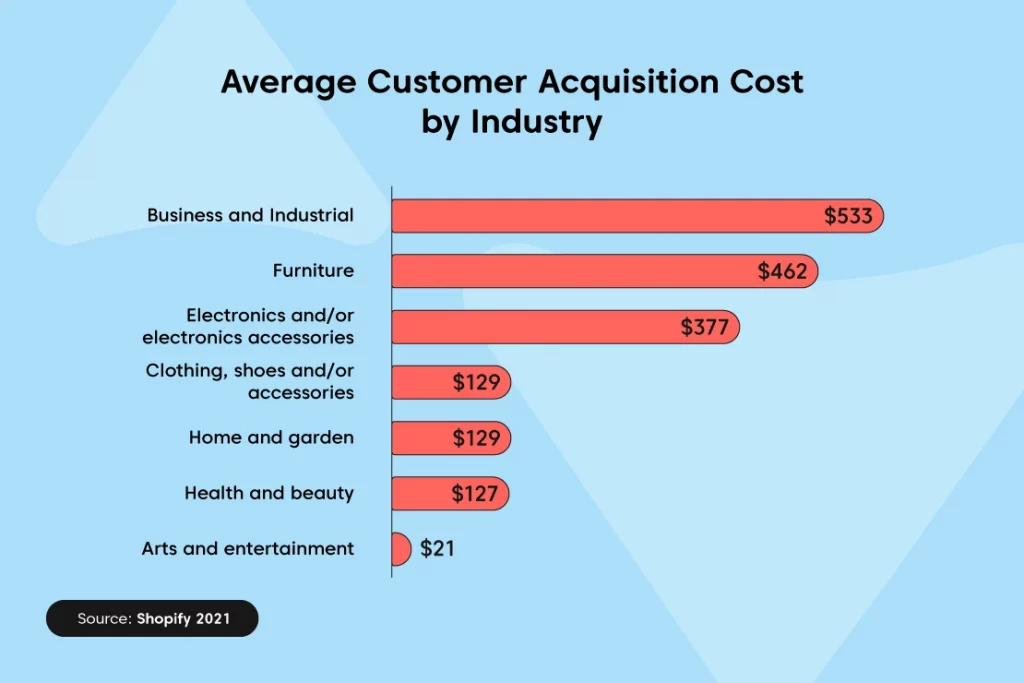

The cost of acquiring new customers has been rising steadily, as competition heats up and audiences become less receptive to messaging. Find out how you can cut down your customer acquisition costs and save your bottom line by reading this blog.

What is customer acquisition cost?

Customer acquisition cost, otherwise known as CAC, is the total cost incurred in getting a new customer to buy your product or service. This cost will include everything from the salaries of marketers or salespeople, the amount spent on a marketing campaign and advertising costs over a specific period of time.

To have a better idea of what performs best, you should measure CAC for each of your channels and campaigns. Calculating CAC is important because it helps you measure the ROI and effectiveness of your marketing and sales efforts.

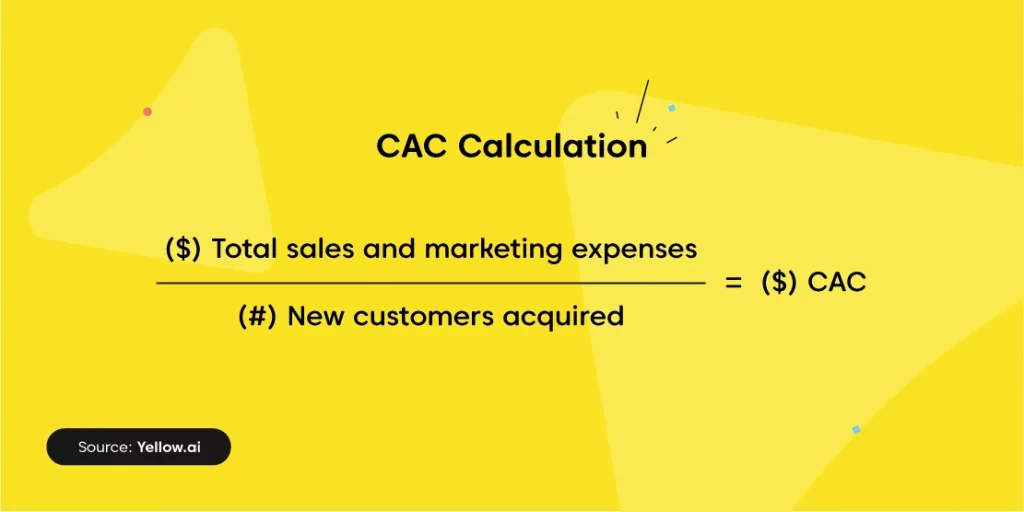

How to calculate customer acquisition cost (CAC)?

To calculate CAC, all you have to do is add all the above-mentioned marketing and sales expenses and divide it by the number of customers you have acquired in that period. For example, in Q1 2022 your company spent $100,000 on marketing, and you acquired 100 new customers. Your CAC is thus $1,000 (100,000 divided by 100).

After calculating CAC, your next step would be to assess it on the basis of a customer’s lifetime value.

Comparing customer lifetime value (LTV) with customer acquisition cost (CAC)

Customer lifetime value or LTV is the total revenue a customer generates over the entire lifetime of their account. The combination of CAC and LTV conveys a prototypical return on investment received from an acquired customer.

This not only shows how efficient a company’s sales and customer acquisition process currently is, but also combines that with how valuable customers can be to a company over their average lifetime.

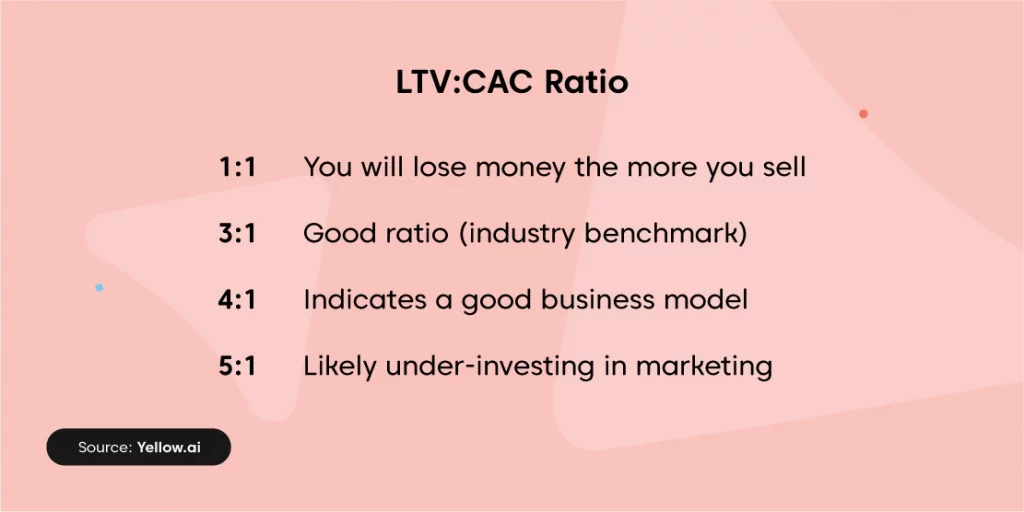

Simply put, CAC:LTV is a ratio that compares your client acquisition cost to their average lifetime value. This ratio might help you figure out how much you’re spending vs how much new business you’re bringing in. Ideally, you should aim for a ratio of 3:1.

If your ratio is too low, it means you’re probably spending too much, but if it’s too high, it means you have an opportunity to increase your expenditure and drive more revenue.

8 Impactful ways to reduce your customer acquisition cost

1. Understand what customers want

The first and the most important thing to consider when trying to slash CAC is to know your customers better. Having a higher customer acquisition cost can represent that you are not bringing the right solutions to your customers at the right channel or time. By creating buyer personas, you can step in your customers’ shoes and identify what clicks for them and what doesn’t.

Get Your Free Template

2. Identify the target audience

It is important to use marketing strategies and resources for the right audiences. Finding your target audience will help you create a tone of voice that really resonates with your customer.

Essentially, a target audience analysis gives direction to your marketing initiatives and ensures more consistency in your messaging, so you can build stronger relationships with customers and offer them exactly what they need.

3. Reduce customer churn

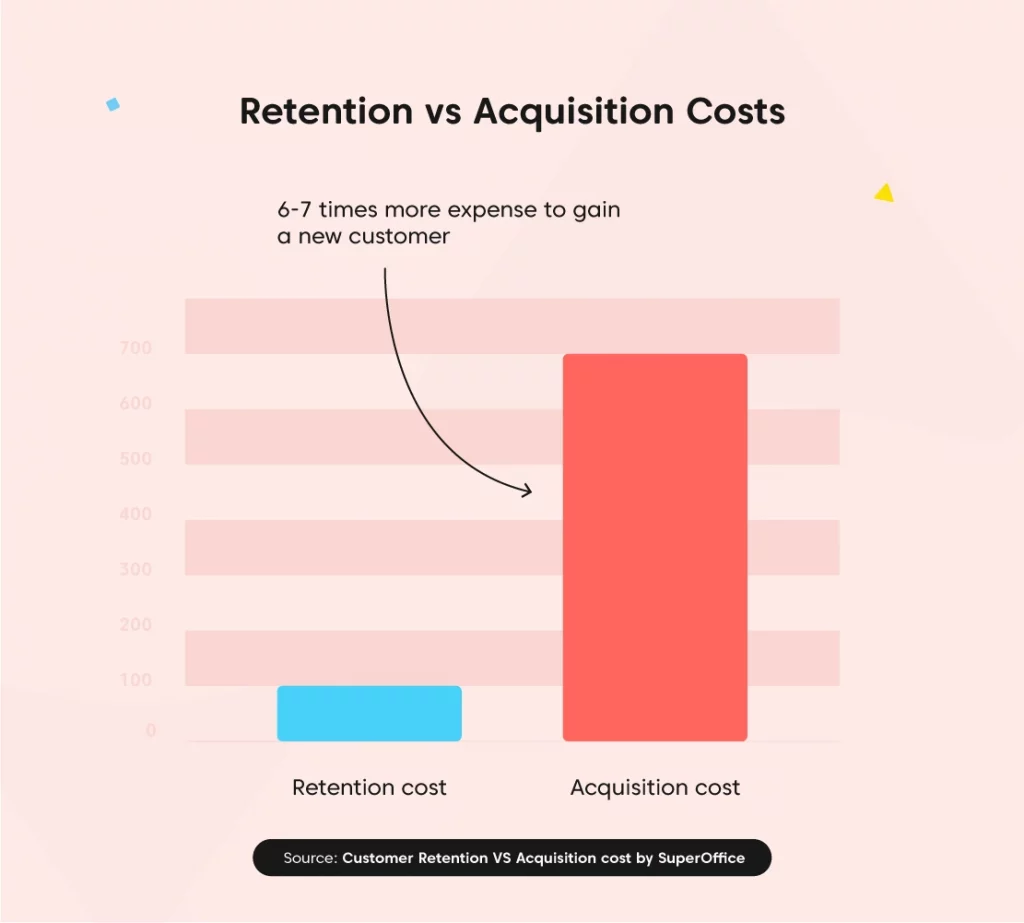

When churn occurs, not only does your marketing team have to dedicate time and resources to bring in new leads, but now they also have to focus on re-engaging lost clients. Did you know that acquiring a new customer could cost almost 7 times more than retaining an existing customer? This is why it’s important to monitor customer churn and make sure you take appropriate measures to reduce it.

One of the best ways to prevent customer churn is to keep a check on customer pulse. This means you need to proactively engage with them and seek feedback to know whether they are happy with your product or service. Chatbots can help you gather customer feedback at scale and derive helpful insights into customer behavior that you can use to optimize your product and processes.

4. Shorten the sales cycle

The longer it takes to convert produced leads into sales, the more money you’ll spend, and the CAC will rise. You can reduce your accumulated cost and boost your return on investment by shortening the sales cycle. You may utilize marketing automation tools such as chatbots to nurture your leads and move them quickly through the sales funnel.

Infact, AI-powered chatbots can help you generate up to 25% more leads, score and segment them on the basis of predefined metrics and provide faster responses and follow-ups for a speedier sales cycle.

5. Reach customers on their preferred channels

Research suggests that up to 75% of customers back out from a purchase because they had to switch between multiple channels. This then forces businesses to spend heavily on email marketing, retargeting and other avenues to bring customers back, ultimately increasing the CAC.

A better approach would be to meet customers where they are and enable them to complete their purchase without having to navigate through multiple channels. For example, if a customer tries to inquire about a product or an offer on instagram – Use instagram bot to greet the customer, engage and answer their questions in real-time, send them personalized offers as well as enable them to make payment right from the chat interface.

6. Ask current customers for referrals

Businesses can obtain higher-quality clients at a cheaper cost by using referral marketing. Referral marketing, unlike traditional marketing channels, lowers client acquisition costs by utilizing existing consumers to help spread the word, which is critical to boosting the bottom line.

According to a study conducted in Wharton Business School, referred customers, on average, were $0.45 more profitable per day than any other customers. In addition, the customer acquisition cost (CAC) for these customers was $23.12 less than non-referred customers. If you consider the initial reward over a six-year span, then referred customers have a 60% larger return on investment (ROI).

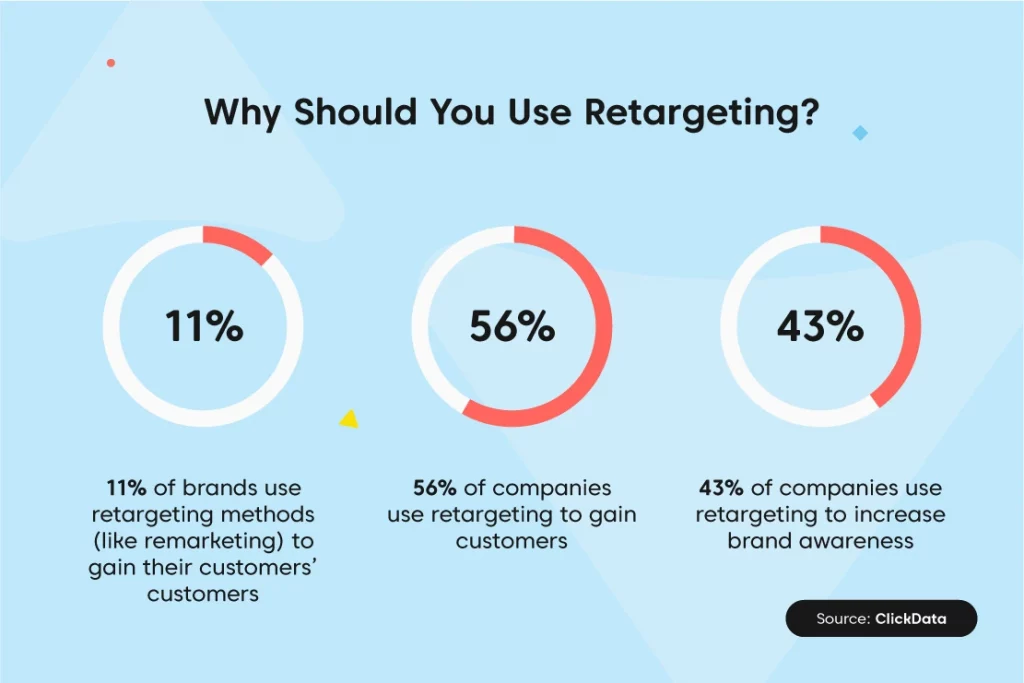

7. Retarget to bring customers back

Retargeting, also known as remarketing, is one of the simplest strategies to attract users back into the funnel and achieve an ideal CAC . You can leverage the Google Ads display network or Facebook Ads to do this, however, using chatbots for retargeting is the most cost-effective technique to rekindle clients’ interest in your product or service.

For instance, if a customer came to your website and interacted with your chatbot, the bot automatically captures all the required information about the user.

Now, if the user leaves the website, the chatbot will ping them on WhatsApp with a custom message or an offer that incentivizes the customer to complete their purchase. Also, chatbot retargeting is free of cost. Chatbots can re-engage with thousands of prospects and send them personalized messages, giving you a better chance at conversions.

8. Increase average purchase value

By now, you probably have a good idea of the strategies you can implement to reduce your CAC. There is also another way that may not directly impact customer acquisition cost but accelerates your path to profitability; it’s to increase your average order value (AOV).

Increasing your average order value can offset customer acquisition costs and increase ROI. You can increase your AOV by up-selling and cross-selling. A chatbot that is programmed using high-tech capabilities such as NLP, NLU, AI and machine learning, will be able to use customer data to make suitable up-selling and cross-selling product suggestions. They can entice customers to try different high-value packages, eventually resulting in increased revenue.

To sum up

CAC is a useful tool for calculating marketing ROI. You receive a quantified estimate of what you are spending to bring in a new customer in the short term, and you get a long-term picture of how much money you generate from each conversion.

You can utilize Yellow.ai automation and campaign management tools to convert more consumers and lower your CAC by designing compelling marketing campaigns, shortening the sales cycles, and automating end-to-end customer journeys. Learn more about how our total experience automation platform can help your business, and talk to our experts!