Bots in Banking and Non-Banking Financial Companies

The digital revolution

Undeniably, digitization has ushered in a banking revolution that by extension includes finance and investment related companies. In the last 15 years, banks have adopted technology-driven banking and retail lending. Exceedingly, the digital payments revolution is expected to trigger massive changes in the way India works with credit. For instance, after demonetisation, debit cards have rapidly replaced credit cards as the preferred payment mode in India.

Post-pandemic repercussions

The post-pandemic world we are grappling with is much-different than the one we left behind, bringing in even more digitization, some of it even overnight. Banks have embraced automation in multiple facets that were once considered impossible to be done online. These include account openings, closures and even KYCs online. In fact at Yellow.ai, we have grown 470% in recurring revenue and scored hundreds of new customers bringing automation to the $1.3T support sector expanding our operations to automate Commerce, Marketing, HR, and ITSM.

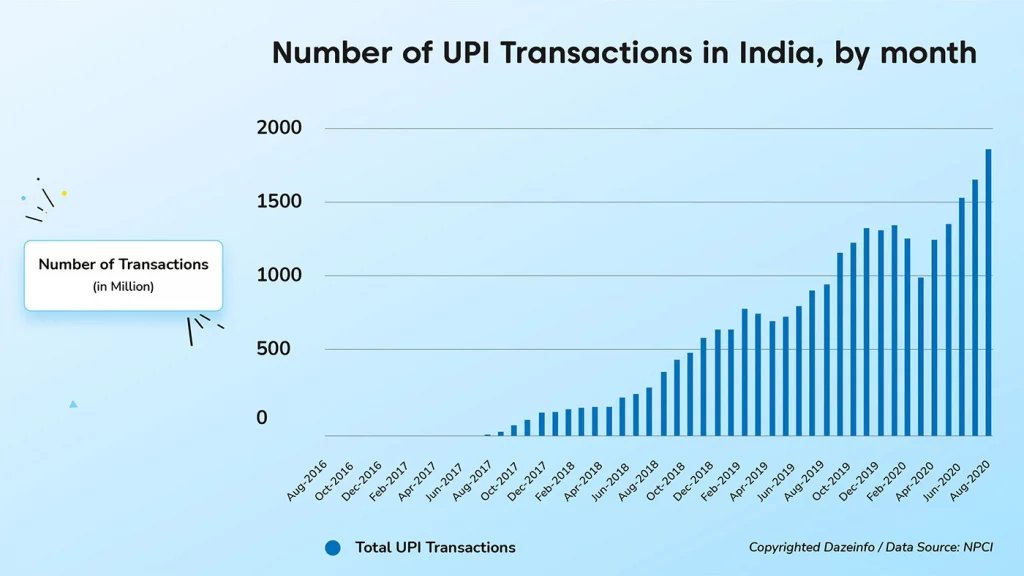

Digital payments have had a boost like never before too. In fact, as of April 2021, Unified Payments Interface (UPI) in India recorded 2.73 billion transactions worth Rs. 4.93 lakh crore (US$ 67.31 billion). Furthermore, Deloitte forecasts that banks will need to continue to focus on improving the digitization of more of their operations, remain flexible to new business models and of course, put customers at the heart of their digital strategy, all of this resulting in a need to conserve existing manpower for more pressing tasks that require ad hoc solutions, rather than repetitive ones.

From conservation to conversation

Conversational Artificial Intelligence powered bots are all the buzzword at the moment and the banking and NBFIs (Non-Banking Financial Institutions) have embraced them with open arms. These bots process customer queries using NLP (Natural Language Processing), resulting in wider interpretations and a more personalised customer experience.

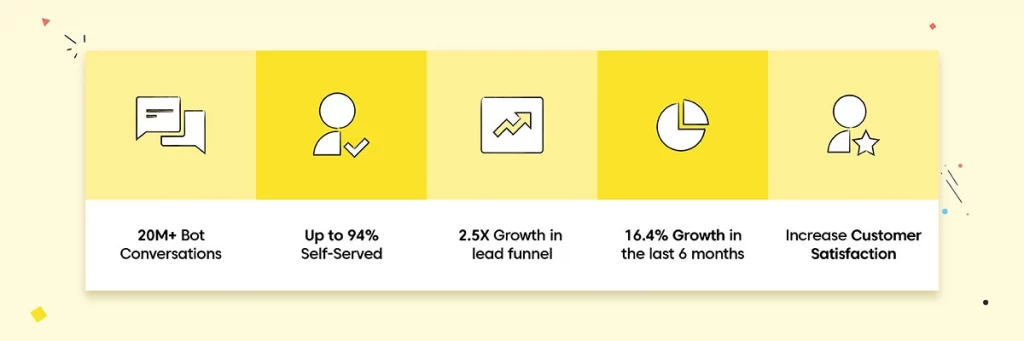

Initially, deployed only with FAQs ( Frequently Asked Questions), present-day bots have undergone a massive makeover for an enhanced user experience. The following infographic summarises just how useful the introduction of chatbots has been to one of our top NBFC clients –

Epsilon research indicates that 80% of the customers return when provided with a seamless and personalized experience. They are also present on all channels and can integrate with existing CRM tools to provide faster time to value.

Most common use cases

1. Lead Generation:

Chatbots can generate leads and the organisation can then qualify them through their preferred channels or a Live Agent in an efficient manner. By creating buyer personas or by curating offers that appeal to that segment, the organisations can reach out to a wide audience to convert them.

2. Customer Support:

Bots provide instant superior customer support for FAQs and more. For instance, a customer can fill out an application and avail a bank loan with just a few clicks from a chatbot. For an existing user, the bot can show the credit card services, even allow the customer to pay bills and recharge, make deposits, set pins, and change policy details to mention a few other automation possibilities. A few additional use cases for NFBCs that can be incorporated here are Ledger clarification, Corporate Balance, Limit Exposure, Add Funds, Loan Application, Premium Payment.

3. Selective Live agent support:

Using bots, one can reduce the customer waiting time and decrease the workload of the call centre agents. This results in tangible savings in the long run. The average session time spent on the chatbot is only about 2:1 mins to get simple queries solved as opposed to a live agent who takes nearly 10:36 mins for it to get resolved.

4. Cognitive Document Processing:

Industries such as banking deal with a lot of paperwork and are trapped in a never-ending loop of manual integration with the backend systems. Our Insights Engine helps by saving operational costs and time using AI and ML to extract data and categorize the document.

The takeaway

Juniper Research claims operational cost savings from using chatbots in banking will reach $7.3 billion globally by 2023, way higher than the estimated $209M in 2019. The time saved for banks in 2023 is to the tune of 862 million hours!

Furthermore

1. Huge savings in operational costs by using bots.

2. The bank will be able to provide 24×7 support for most issues that don’t require a Live Agent.

3. Bots will help detect the problems in any executions of bank orders and resolve usability issues.

4. Reduce attrition in the company as the working personnel are not taxed by repetitive tasks.

5. Increase CSAT and NPS ratings leading to an overall growth in the company.

The future of automated banking is exciting. It’s fair to say that with the advancement of Artificial Intelligence, it is now possible to deliver the best-customer experience while saving the company a lot of funds and banks must leverage this opportunity to build the capabilities and the systems to reach and scale this automation.