In the era of heightened customer expectations, even a deep-seated sector such as BFSI has recognized that legacy processes and systems won’t suffice.

Financial institutions, to remain competitive are constantly trying to improve their CX by staying abreast of all the latest trends in their industry.

Well, there is a lot that can be done to improve customer experience, but to help you cut through the clutter, here we have a list of the top 7 CX trends that are expected to make the most impact for the BFSI sector in 2022.

7 Trends transforming BFSI customer experience in 2022

1. Hyper-personalization – No. 1 customer demand

Hyper-personalization is about delivering custom and individualized experiences by leveraging contextual data, advanced analytics, AI and automation. Customers are always on the lookout for services that save their time and effort. So imagine the kind of preference they would give to your business if you are able to predict your customers’ needs even before they arise.

BFSI firms should proactively pursue hyper-personalization because it’s an opportunity to increase engagement and foster customer loyalty. In addition, it will enable them to send highly targeted communications to specific customers at the right place and time, using the right channel.

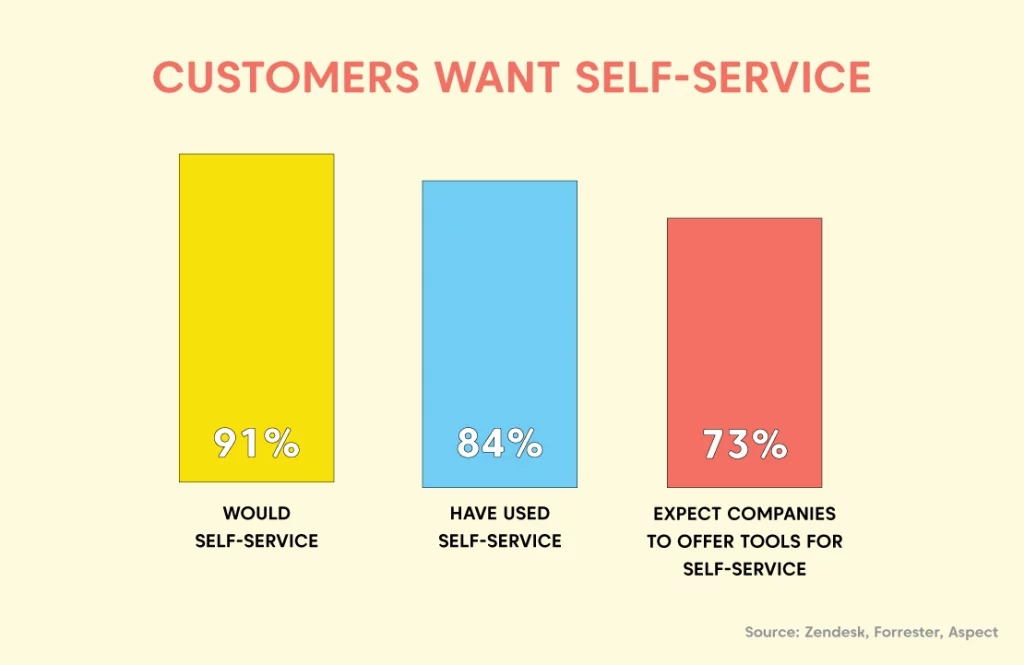

2. Self-service – Preferred by 69% of customers

A recent study revealed that 69% of customers prefer troubleshooting their problems themselves before contacting an agent for help. This catalyzes end-to-end self-service to become a valuable tool when it comes to providing proactive support to customers in the BFSI industry.

Financial institutions can now offer clients a self-service paradigm that promotes more customized and faster interactions with the help of AI-powered virtual assistants. This enables customers to perform simple operations independently, such as filing a claim, processing a refund, changing credit card limits, renewing policies, reporting stolen cards, or paying premiums.

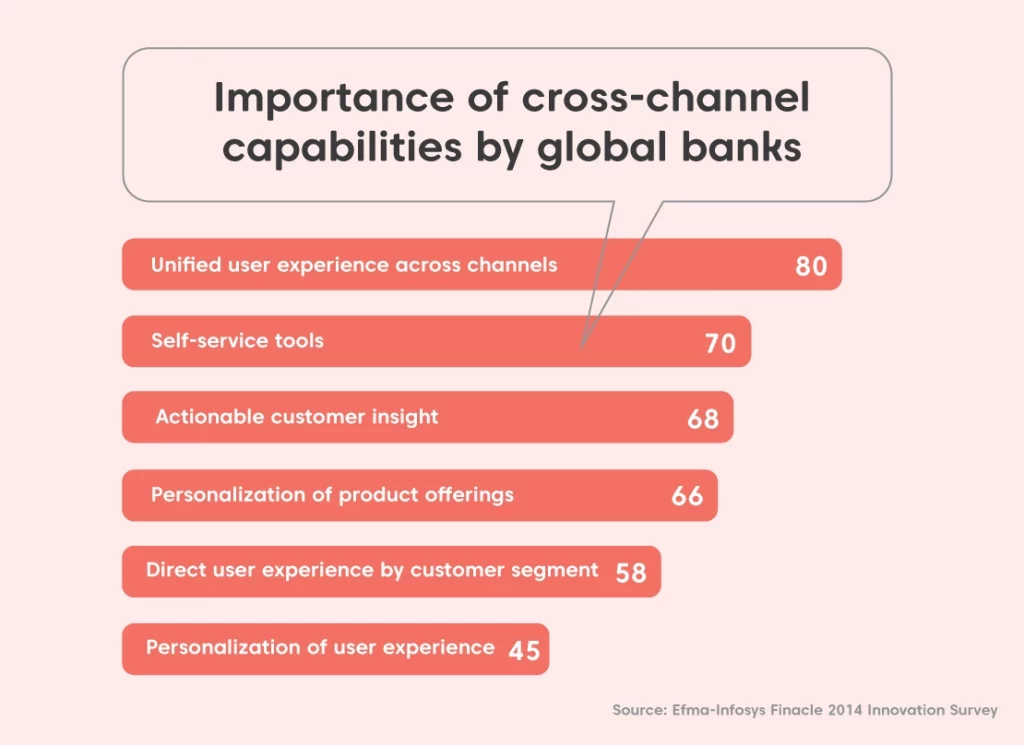

3. Omnichannel CX – Expected by 90% of customers

A study by ClickZ found that 9 out of 10 customers preferred an omnichannel experience when dealing with multiple business channels. Businesses that could provide this experience retained 89% of their customers, well outperforming any industry average, and their customer lifetime value (CLTV) was boosted by 30%.

As for the BFSI sector, the pandemic led to a channel migration among banking and finance customers. As of now, 2.5 billion users across the world use BFSI services digitally and if just talk about banking, almost 53 per cent of the global population will access digital banking by 2026. This makes it important for businesses to be readily accessible on multiple platforms so that users can have the convenience of connecting with them on their preferred channels.

4. Intelligent chatbots – Cutting workload by 80%

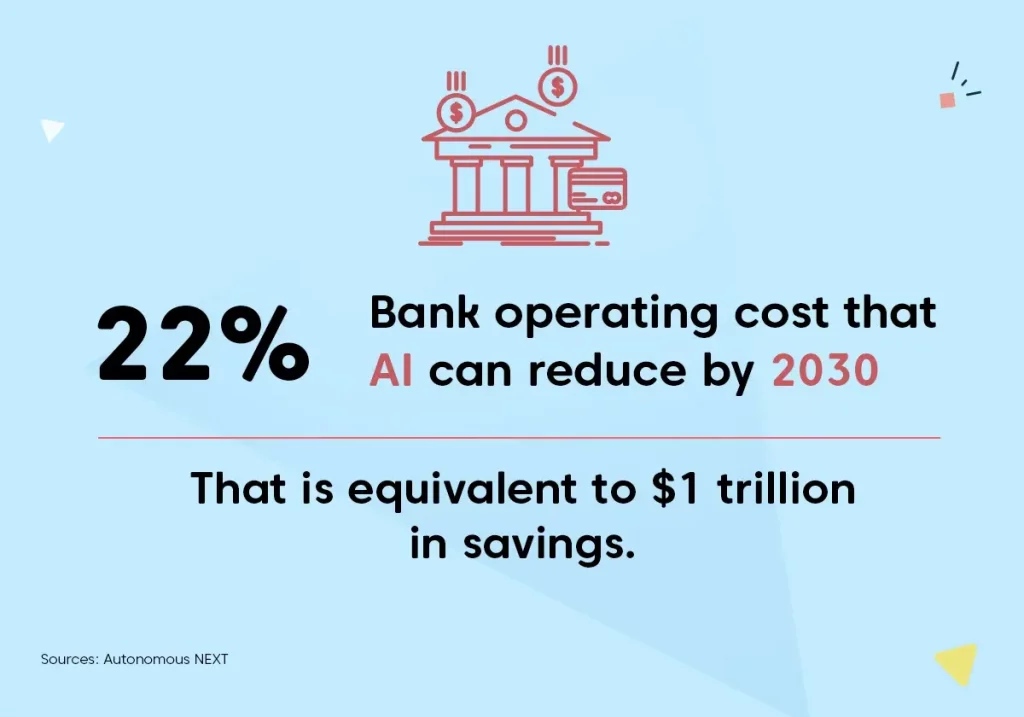

Chatbots are already experiencing a wide adoption throughout industries, but many BFSI organizations are still hesitant to embrace them. Well, this is expected to change in 2022 as more companies take a leap towards AI to improve their total customer experience.

A recent report by Juniper Research suggests that by 2023 chatbots will account for 79% of successful interactions in mobile banking apps. The driving forces behind such adoption are the cutting-edge technologies such as NLP, NLU, AI and machine learning, that back the intelligent chatbots of today. These technologies have made chatbots capable of handling up to 80% of all customer inquiries without human intervention, enabling companies to offer 24/7 support at a fraction of the cost.

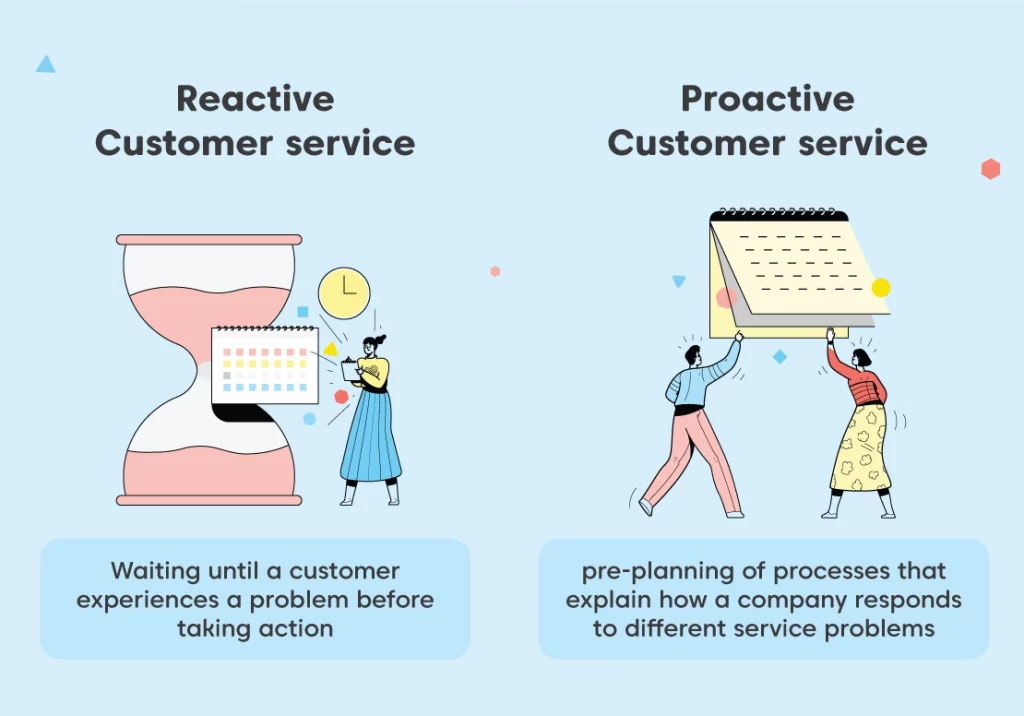

5. Proactive customer service – Favoured by 7 out of 10 customers

70% of customers prefer a brand that provides proactive customer service. Advancements in the fields of data collection, analytics, and automation have allowed financial institutions to always stay one step ahead and solve customer problems even before they arise.

Especially, since we are talking about the BFSI sector, proactive customer engagement is indispensable. It can help banks and other financial institutions deliver a top-notch customer experience while also improving their bottom line.

Companies to enhance their overall brand experience and trust can employ proactive chatbots that send reminders to customers about premium payments, new policies or offers and keep them engaged throughout their journey.

6. Customer centricity – Making businesses 60% more profitable

From the point of view of profits and revenue, research by Deloitte and Touche found that customer-centric companies are 60% more profitable compared to companies that do not keep customers at the core of their strategies.

BFSI companies need to start looking into ways to simplify the purchasing processes for customers. It is the very heart of any customer-centric strategy and one of the most efficient ways to do that is by employing Conversational AI.

By assisting your customers using intelligent text and voice bots, you can understand customers’ intent in real-time and engage them in more meaningful conversations. This will help you better understand who your customers are, what interests them, and what they value.

7. Customer science – Reducing payments fraud drastically

We often talk about improving customer experience but forget the role analytics play in the whole scenario. It’s one thing to scale your customer service efforts, use chatbots, go omnichannel and it’s another to actually look into how your customers are reacting to the whole experience.

That’s when customer science comes into play. Custom science is the use of technologies, AI, and customer data to understand and predict customer needs and build experiences that meet them. In the BFSI sector, it is mostly used in curtailing risks and fraud management.

Conclusion

The latest CX trends in the BFSI industry are going to be all about exploring new frontiers of personalization and automation to meet increased customer expectations. Banking and finance companies, to improve their customer experience, will need to think beyond traditional support and enrich their current CX strategies with cutting-edge AI-powered tools.

It can be challenging to adopt automation at scale, but with the help of Yellow.ai, the world’s leading conversational CX platform, you can achieve 60% automation in just 30 days. Request a demo to know more about how our CX automation solutions can help you drive business growth.